Why do hard insurance markets occur, and how long do they last?

Hard insurance markets occur when the demand for insurance coverage exceeds the supply of available insurance capacity. This can happen due to a number of reasons, such as an increase in catastrophic events, an increase in claims frequency or severity, changes in regulations or government policies, and changes in the investment environment. When insurance companies are faced with these increased risks and uncertainties, they become more selective about the risks they are willing to insure, and they may also raise premiums and reduce coverage limits to better manage their exposure.

The length of hard insurance markets can vary widely, and there is no fixed timeline for when they will end. In some cases, they may last only a few months or a year, while in other cases, they can last several years or even longer. The duration of a hard insurance market depends on factors, such as the severity and frequency of the losses being experienced, the willingness of insurers to enter or expand their business in the affected market, and the ability of insurers to manage their risks effectively. Additionally, the impact of external factors, such as regulatory changes or shifts in the investment environment, can also play a role in determining the duration of a hard insurance market.

How does a consumer of insurance best navigate a hard insurance market?

As market cycles differ, it is imperative that you understand the dynamics behind a firming market. Hardening markets occurred for different reasons in the 1980s and early 2000s. As it has been nearly 20 years since we experienced a hard market, this may be your first hard market storm.

Navigating a hard insurance market can be challenging for consumers, as you may face higher premiums, reduced coverage options, and a more stringent underwriting process. However, working hand-in-hand with your broker there are several steps that you can take to help obtain the insurance coverage you need in a hard market:

-

Set Yourself Apart as a Risk. As insurance company underwriters are deluged with submissions, it is imperative that you distinguish your account in the eyes of the underwriting community. Ask yourself the following questions:

- What makes my account more attractive than others in my marketplace?

- How can I best convey these attributes to the underwriting community?

- Work with an Experienced and Creative Broker: Your insurance broker should help you navigate the insurance market and find preferred terms and conditions. Insurance brokers have a deep understanding of the market and can help you identify insurers that specialize in your risk profile. Most importantly, they can package your account in a manner that gets it to the top of the underwriting stack.

- Risk Profile Improvement: Insurers are more willing to offer preferred insurance terms and conditions to customers who demonstrate that they have taken steps to reduce their risks. Rethink and update loss control measures. Work with your broker to prepare a report showing why you are a superior risk. Implementing risk management strategies to reduce the potential for loss will make you more attractive to insurers. Risk profile improvement is front and center.

- Tune-Up Your Claims Data: Get your loss runs in first-class condition. Close dormant claims and put realistic reserves on those remaining open. Include complete details on larger claims. Have your broker perform a historical loss ratio analysis. Good data is important in all market conditions, however, your ability to demonstrate profitable loss history is a key to finding favorable terms in a hard market.

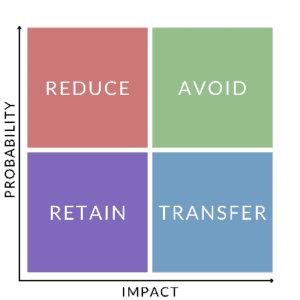

- Review your coverage needs: In a hard market, insurers may limit coverage options or increase premiums for certain types of coverage. It’s essential to review your insurance needs and make sure you are only paying for the coverage you need. Prepare to retain more risk through higher deductibles. Consider using a Risk Decision Matrix, such as the one shown below.

- Tell Your Story: If possible, tell your story to the underwriting community. Communicate the positive attributes of your risk including risk profile improvement initiatives. With the help of your broker, this can be accomplished in many ways, including a thoughtfully crafted video, phone discussion with underwriters, or face-to-face meetings with underwriting teams. Creativity is required in a hard market.

By taking these steps, you can better navigate a hard insurance market and find the program you need at a fair price.